Business Savings Accounts

Savings Solutions That Work For Your Business

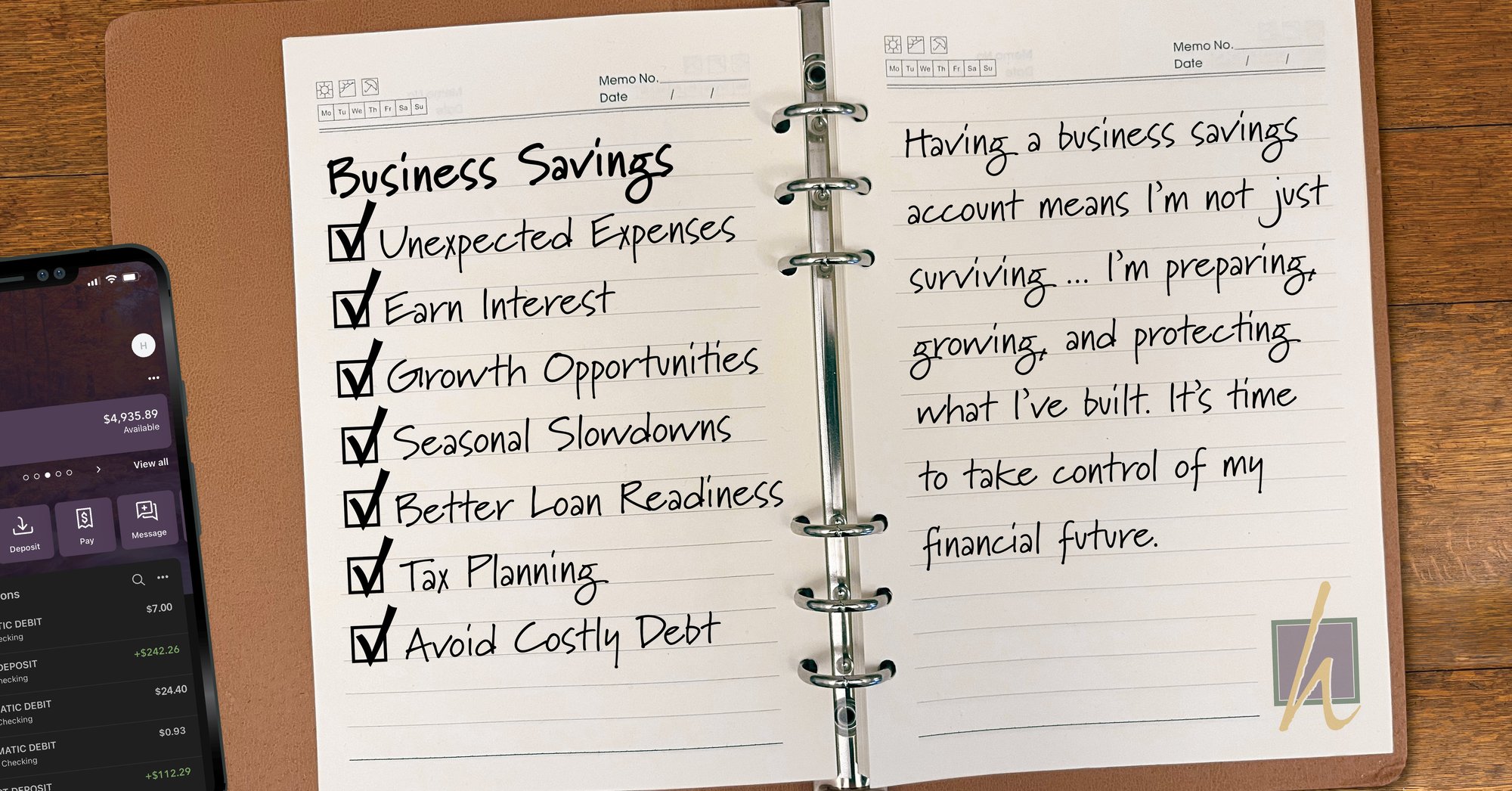

You’ve earned your money through sweat and sacrifice – now let it work just as hard for you! Our business savings accounts feature competitive interest rates to help your funds grow faster. Whether you’re preparing for an unexpected expense, like a tractor repair, or you have ambitions of opening a second location down the road, a Heritage Bank business savings account ensures you’re ready for whatever obstacles or opportunities lie ahead.

Why Should Your Business Have a Savings Account?

Business savings accounts not only help separate your personal and business finances, they can grow your money by allowing you to earn interest. Plus, funds in our business savings account are federally insured by the FDIC up to applicable limits.

Friendly, local service found here. Always.

We’re out in the community a lot, and I love overhearing people bragging about our bank and how friendly the staff is here. We take great pride in serving our Neighbors.

Amber Foote

Vice President - Deposit Operations